operating cash flow ratio industry average

The formula for calculating the operating cash flow ratio is as follows. Industry Ratios included in Value Line.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

A higher ratio is preferable because the company can raise more money for each dollar of its revenue.

. 75 rows Cash Ratio - breakdown by industry. Due to repayements of liabilities of 246 Industry improved Liabilities to Equity ratio in 1 Q 2022 to 143 above Oil And Gas Production Industry average. Cash ratio is a refinement of quick ratio and.

OCR Ratio Cash flow from operating activities Current liabilities 872 975 089. Retail Sector Free Cash Flow current historic quarterly and Annual growth rates statistics and averages - CSIMarket from 2 Q 2022 to 2 Q 2021. This compares to 14 for those industries with the largest cash balances at 20-40 of sales.

If the ratio is less than 10 then the firm is suffering a liquidity crisis and is in danger of. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is incapable of paying off short-term liabilities at this point. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

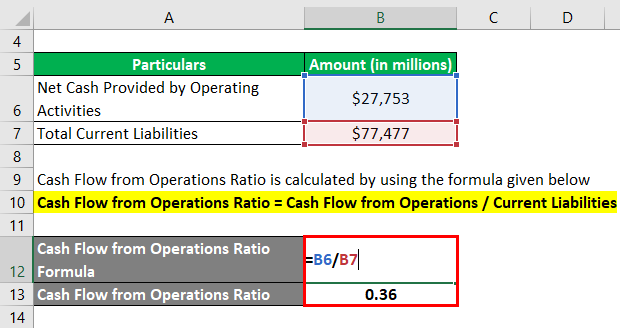

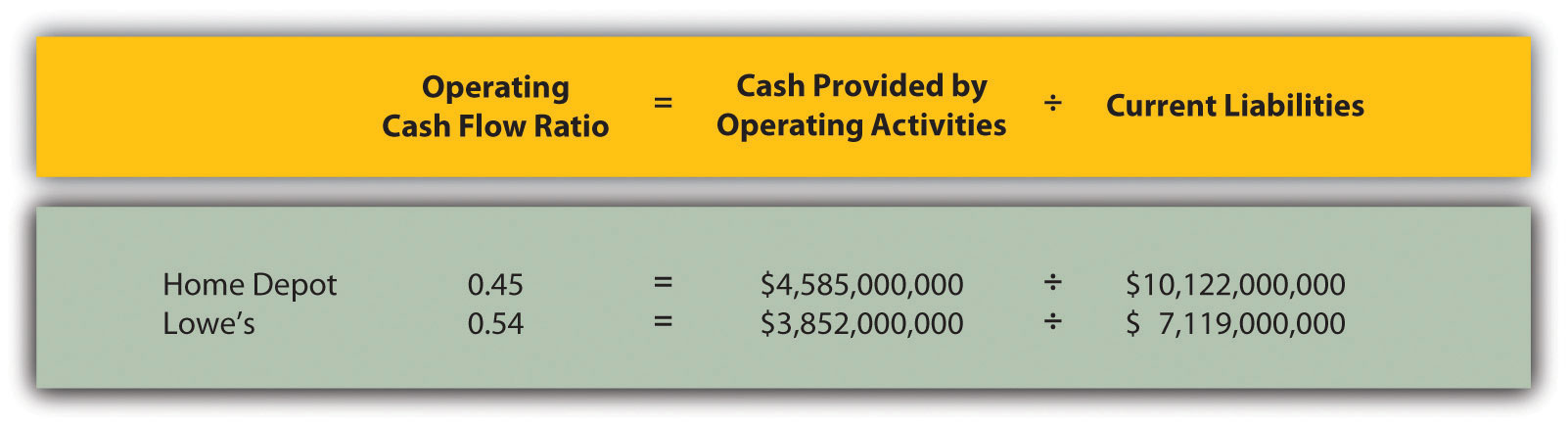

Among other Industries in the Energy sector 3 other industries have achieved lower Leverage Ratio. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. Considering the formula for operating cash flow ratio the ratio will be 036 278 billion 775 billion for Walmart and 034 for Target 6 billion 176 billion.

An Operating Cash Flow Ratio is an accounting ratio that shows the amount a company uses for ongoing operations divided by its operating cash flow adjusted for non-recurring itemsThe Operating Cash Flow. The Times Interest Earned Ratio is. Operating Cash Flow Ratio is a key metric for success as a business to measure how much cash a company brings in from assets compared to how much it invests in assets.

The operating cash flow refers to the cash that a company generates through its core operating activities. The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. This means that the operating cash flow margin for Aswac is 63.

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet. Value Investment Funds Two 34 Year Running Average Annual Return After Quarterly. Meaning the interest of The Learning Company was covered 9 times.

18000 2000 9. 75 rows Cash Ratio - breakdown by industry. Cash flow from operations can be found on a companys statement of cash flows.

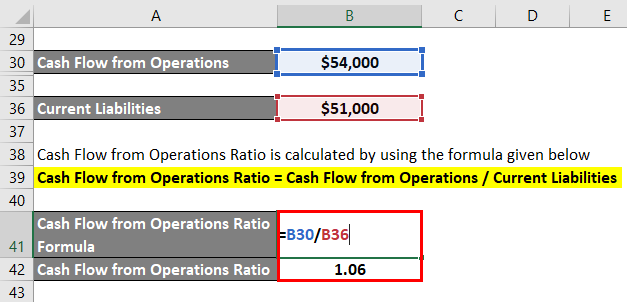

In this example for every dollar made in net sales 063 is operating cash. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities. Now let us consider another example.

Leverage Ratio overall ranking has fallen relative to the prior quarter from to 28. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6. In the time period of a year Walmart had operating cash flow of 278 billion and Target had that of 6 billion.

This ratio is calculated by dividing operating cash flow a figure that can be obtained from a companys cash flow statement by total debt obligations. The formula to calculate the ratio is as follows. Operating Margin Income Tax Rate Net Profit Margin Return on.

The operating cash flow ratio is a measure of a companys liquidity. Hence with the operating cash flow ratio formula. This may signal a need for more capital.

Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio. In 2014 Times Interest Earned was. All Industries Measure of center.

A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities. Average industry financial ratios for US. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that.

Median recommended average Financial ratio. It reveals a companys ability to meet its. Thus investors and analysts typically prefer higher operating cash flow ratios.

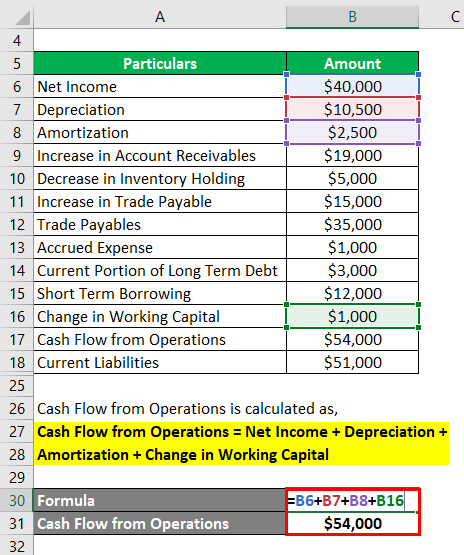

Cash flow to revenue measures how successfully the company converts its revenue into cash. The user must understand how cash flow from operations is calculated. Cash flow to revenue CFO Revenue.

Cash flow margin Cash flow from operating activities net sales x 100. Since earnings involve accruals and can be manipulated by management the operating cash flow ratio is considered a very helpful gauge of a companys short-term liquidity. Net cash flow from operating activities comes from the statement of cash flows and average current liabilities comes from the balance sheet.

Total Capital Return on Shareholder Equity Retained Earnings to Common Equity All Dividends to Net Profit Average Annual Price to Earnings Ratio Relative Price to Earnings Ratio Average Annual Dividend Yield. Targets operating cash flow ratio works out to. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities.

This number can be found on a companys cash flow statement. Average industry financial ratios for US. Cash return on assets cash ROA Cash return on assets is similar to return on assets.

This corresponds to a value of 1 or little higher than 1. Liquidity ratios Current ratio Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages 53 4 4 4433333333 Industry Income Statement Assumption SHL Annual Revenue change. For example a company had in millions cash flow of 5000 and net sales of 9200 and its cash flow margin 5000 9200 x 100 543.

The operating cash flow margin of 63 is above 50 which is a good indication that the company is efficiently creating operating cash from its sales. A positive percentage here is a good indicator of business profitability and efficiency.

Choose The Best Energy Industry Kpi Template Kpi Energy Industry Data Visualization

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Ratio Definition

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

How Is The Statement Of Cash Flows Prepared And Used

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Ratio Calculator

How Do Net Income And Operating Cash Flow Differ

Price To Cash Flow Formula Example Calculate P Cf Ratio

Ebitda Coverage Ratio Meaning Formula Benefits And More In 2022 Financial Management Financial Analysis Financial Health

Price To Cash Flow Formula Example Calculate P Cf Ratio

7 Cash Flow Ratios Every Value Investor Should Know

Operating Cash Flow Formula Examples With Excel Template Calculator

Cash Conversion Ratio Financial Edge